What is TOREX?

TOREX stands for T(WAP) OR(acle) EX(change). It is a core mechanism and the smart contract engine used to make sure that the funds accumulated (in-tokens) on the main SuperBoring contract are continuously and efficiently swapped for the destination asset (called out-tokens).

A time-weighted average price (TWAP) is a trading benchmark that's generally used in finance to measure the price of an asset over a specific time frame. It is calculated by taking the average price of the asset over a set amount of time, and it is often used to evaluate the execution of larger orders.

Introduction

TOREX is a unique way for traders to swap one asset for another using smart contracts, where:

- The swaps are performed time-continuously. This way of exchange is also known as a "reactive exchange."

- Using a time-weighted price oracle (TWAP) to regulate the aggregation of liquidity sources gives traders a fair price over time.

- The origins of liquidity sources for the exchanges are agnostic to the exchange. This means that the liquidity sources can be from any source, such as Uniswap V3 pools.

TOREX uses the TWAP oracles provided by Uniswap V3 pools. To learn more about Uniswap V3, please refer to Uniswap V3 Whitepaper.

Core Logic

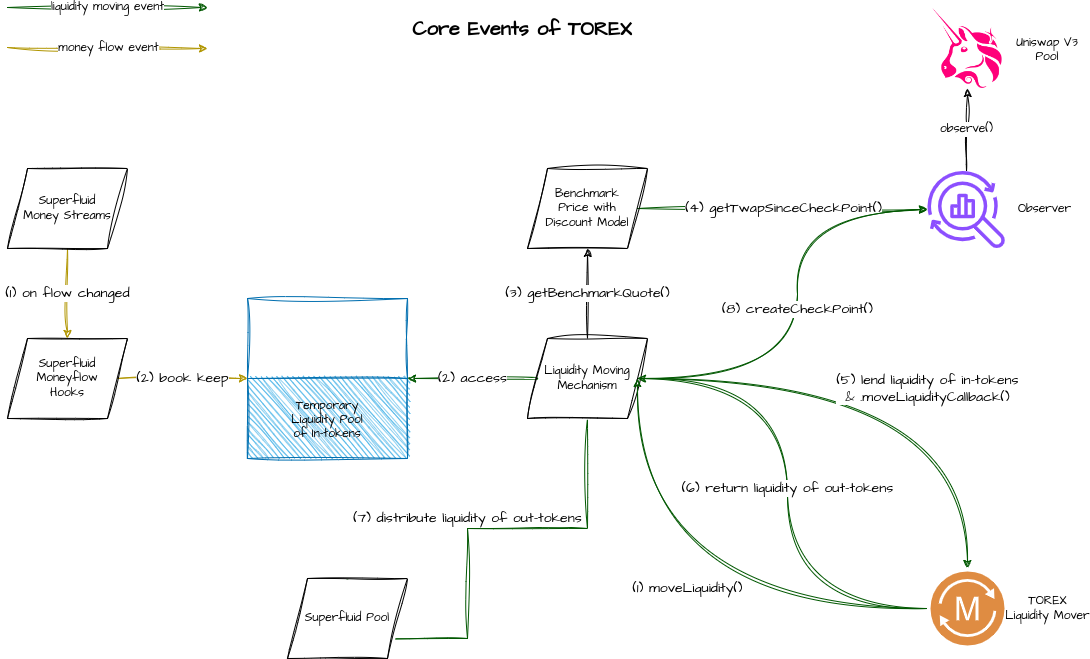

The image below shows the core events of TOREX.

Figure 1: Core events of TOREX.

The core logic of TOREX is to swap the source asset (called in-tokens) for the destination asset (called out-tokens) continuously.

To do so, each TOREX book keeps money streams from traders, maintains a temporary liquidity pool of in-tokens, and offers the liquidity to Liquidity Movers at a benchmark quote for an amount of out-tokens.

At a Liquidity Movement event, the TOREX receives the quoted amount of out-tokens and distributes them to the traders through Superfluid' Distribution Pools.

A Liquidity Mover is a user who facilitate trades for incoming streams. They compete with each other closing trades through our Liquidity Solution using Instant Distributions, and receive a fee in exchange. Learn more about Liquidity Movement in the next section.

Liquidity Movement

A Liquidity Mover is an an operator which creates and manages an on-chain Liquidity Mover contract. The Liquidity Mover contract is a smart contract that interacts with the TOREX smart contract to facilitate trades for incoming streams.

To trigger a Liquidity Movement event, the Liquidity Mover contract must call the moveLiquidity function of the TOREX smart contract. This makes TOREX do the following:

- Check the balance of the temporary liquidity pool of in-tokens.

- Get the benchmark TWAP price from the Uniswap V3 pool.

- Adds a discount to the benchmark TWAP price to incentivize the Liquidity Mover to close the trade.

- Make sure that the Liquidity Mover gives back the quoted amount of out-tokens to the TOREX.

- Distribute the quoted amount of out-tokens to the users.

The discount model follows a shifted reciprocal function where is the discount factor, is the full value without discount, and is the relative time since the discount should start applying. As you can notice, when is 0, it applies zero discount, while at the infinite future, the entire value is discounted.

Learn More

TOREX is a complex system with many moving parts. To learn more about TOREX, please refer to the TOREX Whitepaper.